Integrated Equities Limited – Privacy Policy, Disclosures & Risk

Statement

At Integrated Equities Limited (IEL), we are committed to

maintaining the highest standards of integrity, transparency, and

client protection in all our dealings. As a licensed securities

broker regulated by the Securities and Exchange Commission of

Pakistan (SECP) and a Trading Right Entitlement Certificate (TREC)

holder at the Pakistan Stock Exchange (PSX), IEL strictly adheres

to the rules, regulations, and codes of conduct mandated by

relevant authorities. This comprehensive statement outlines our

Privacy Policy, Risk Disclosures, and other regulatory

commitments, aimed at ensuring that our clients are fully informed

and confident in their engagement with us.

Privacy and Data Protection Policy

IEL is fully committed to protecting the privacy and personal data

of its clients and website visitors. We collect personal

information only when it is necessary for the provision of our

services or when required under law. The information we may

collect includes, but is not limited to, your name, CNIC, email

address, phone number, mailing address, bank account details,

source of income, and financial history. This data is typically

gathered during the account opening process and through ongoing

regulatory Know Your Customer (KYC) and Customer Due Diligence

(CDD) requirements.

In addition to client-provided information, our systems may

automatically log certain technical data such as IP address,

browser type, device details, website visit time, and user

behavior on our site. This data is used solely for security

monitoring, technical diagnostics, and enhancing the user

experience. IEL uses cookies to improve website functionality.

These cookies do not contain personal information and can be

managed or disabled through your browser settings.

We use your information primarily to process transactions, comply

with regulatory requirements, monitor suspicious activities, offer

customer support, and improve our services. IEL does not sell,

rent, or trade personal data with third parties for commercial

purposes. Your information may be shared only with regulatory

bodies such as SECP, PSX, CDC, NCCPL, or vetted service providers

(e.g., auditors, compliance consultants, or IT infrastructure

vendors) in line with regulatory obligations and data security

protocols.

We maintain strict physical, electronic, and procedural safeguards

to protect your personal data. All employees are trained in

confidentiality protocols, and client data is accessed strictly on

a need-to-know basis. Clients have the right to request access to

their data, seek corrections, and request removal, subject to any

legal data retention requirements imposed by regulators. Continued

use of our website and services constitutes consent to this

privacy policy.

Regulatory and Corporate Disclosures

Integrated Equities Limited operates under the legal framework

established by SECP and follows all applicable guidelines under

the Securities Act, 2015, and associated rules. IEL is a licensed

brokerage house, registered with the Pakistan Stock Exchange

(PSX), and is also a registered participant with the Central

Depository Company (CDC) and National Clearing Company of Pakistan

Limited (NCCPL).

Our governance framework includes a professionally qualified Board

of Directors, supported by independent oversight functions such as

Internal Audit, Compliance, and Risk Management, ensuring that we

remain accountable to both clients and regulators. Annual audited

financial statements are published in accordance with

International Financial Reporting Standards (IFRS), and audits are

conducted by SECP-approved firms. No penalties, sanctions, or

unresolved regulatory complaints are recorded against IEL as of

the latest reporting period.

We believe in full transparency of all charges and fees. Our

commission structure is clearly communicated to all clients during

account onboarding and is available on request. We ensure there

are no hidden charges or unauthorized deductions. We also maintain

a strict Conflict of Interest policy, whereby client and

proprietary trading activities are segregated, and all trades are

executed only upon the client’s instruction or written consent.

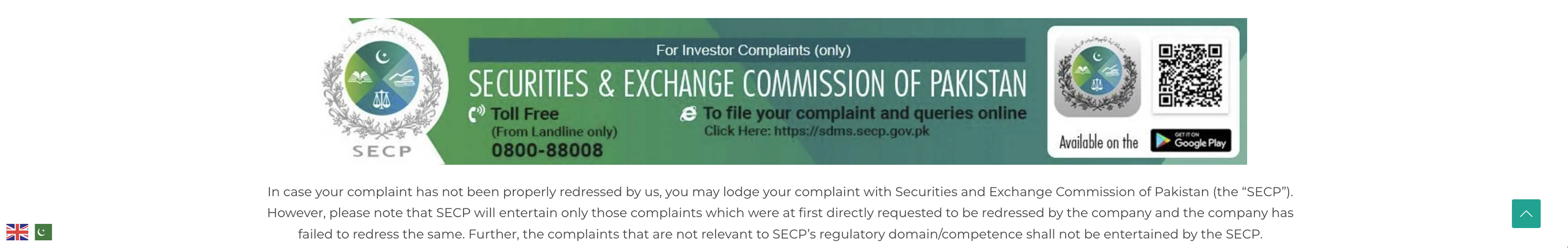

IEL has a documented Complaint Management Process, offering

clients the ability to raise issues through our Compliance

Department. If a matter remains unresolved within fifteen business

days, the client has the right to escalate their complaint to

SECP’s dedicated investor grievance portal.

Risk Disclosure Statement

Investment in the capital markets inherently involves risk. The

value of securities can rise or fall based on various factors,

including market conditions, economic indicators, geopolitical

developments, company-specific performance, and investor

sentiment. IEL advises all clients to carefully consider their

risk appetite before making investment decisions.

Market risk—the potential for an overall decline in the financial

markets—can impact both short-term and long-term investment

returns. Liquidity risk is another important factor, wherein some

stocks may experience low trading volumes, making it difficult to

buy or sell at a desired price. Clients must also understand the

implications of leverage and margin trading, which, while offering

the potential for enhanced returns, can also result in magnified

losses. IEL provides leveraged trading options only to eligible

and risk-assessed clients, and always with full disclosures and

client consent.

Operational risk—including technology failures, internet

disruptions, order mismatches, or execution delays—while minimized

through robust systems and controls, cannot be entirely

eliminated. IEL has contingency plans, redundant systems, and

monitoring protocols in place to mitigate such occurrences.

Clients are also reminded of cybersecurity risk. While IEL

implements industry-standard encryption, firewalls, and user

access controls, clients must also exercise responsibility in

safeguarding their own login credentials, two-factor

authentication, and device hygiene. IEL shall not be liable for

any breaches caused by client-side negligence.

Lastly, regulatory risk must be acknowledged, as market rules and

tax structures may change. Such changes may impact the liquidity,

returns, or valuation of client portfolios.

Client Acknowledgment

By opening an account or using the services provided by Integrated

Equities Limited, the client confirms that they have read and

understood the firm’s privacy policy, regulatory disclosures, and

risk disclosure statement. The client further acknowledges that

they are fully aware of the risks involved in capital market

investments and are making informed investment decisions based on

their own risk tolerance and financial objectives.